As a company listed on the Toronto Stock Exchange (TSX), PAREX’ financial results are public and subject to annual auditing, promoting the transparency of the information provided to its stakeholders. In 2016, due to a low oil price environment, PAREX rolled out a program in which capital expenditures were lower than funds flow from operations.

Throughout the year, PAREX achieved important increases in all reserve categories. Compared to 2015, proved plus probable reserves (2P) increased by 37%, to 112 million barrels of oil equivalent (MMboe), of which 98.6% were crude. PAREX exited 2015 with 82 MMboe of 2P reserves. The 2P Reserve Life Index increased from 8 to 10 years.

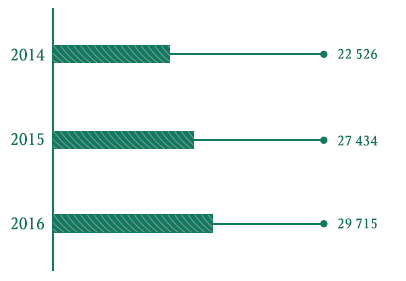

Annual average net daily production increased by 8% compared to 2015, reaching 29,175 barrels of oil equivalent per day (boe/d). During the fourth quarter of 2016, net production was 31,049 boe/d, exceeding the goal of 30,000 boe/d. Forecasts for net production in 2017 are between 34,000 and 36,000 boed/d.